CHAPTER 3: How money is created in the Fiat Standard

This post is Chapter 3 of the book I’m writing. You can read the Introduction here

To understand bitcoin easier, we need to learn how fiat money is printed.

We learned in chapter 2 that since the gold standard closed in 1971, dollars were no longer redeemable to gold. There is no more limit or constraint on how much money can be printed.

But contrary to popular belief, the government doesn’t just print money whenever they want. It is a more elaborate process which involves different government agencies. But once you understand it, you will see that it is still money printing in disguise.

The government can print money whenever they want. They won’t do it at will, but they will be forced to do it (more on this later why).

💸Fiat Standard

Fiat means backed by decree or authority. Fiat money means backed by the faith of the government.

It is common knowledge when you ask people what backs our money to say that it is “backed by the government”. But what exactly does that means?

Even the experts disagree on what really backs our money. Some say that it is backed by the military government, or by petrodollar (oil price in gold) or backed by debt (US government bonds).

First of all, we need to understand that whatever country you are from, the value of your currency depends on the value of US dollar. Another way to say this is that your currency is measured against the US dollar because the US dollar is the world’s reserve currency.

Most international trade is done using US dollars. If your country import something, they pay it in dollars. If your country export something, they receive dollars in payment.

We use local currency in transacting in our daily lives, but on nation states level, countries trade using US dollars. Saudi won’t accept Philippine Peso as payment for selling their oil. They sell oil for US dollars.

On the bigger scheme of things, we live on a US dollar standard.

Therefore, to understand how all fiat money is created, we need to ask the specific question of how the US dollar is created, because all fiat currencies whether Yen, Peso, etc. derived their value from the US dollar.

🤔How US Dollar is created

The government issues more money through the issuance of debt.

This debt is called government bonds. These government bonds are sometimes referred to as US treasuries.

When US issues government bonds, they are borrowing money from us.

It’s just like a normal lending where the borrower (the US government) pays interest over the term of the loan.

At the end of the term, they will pay back what they borrow.

So, if you buy $1,000 worth of government bonds with term of 10 years, the government will pay you interest over 10 years.

After 10 years, they will pay you back the principal amount of $1,000.

The government uses this money they get from issuing government bonds to pay for their expenses.

So how is there new money created if the US just borrows money from us?

The US government just like a business or individual, earns money and spend money.

But the problem is the US spend more money than what they earn. On top of that, they have growing amount of debt that they need to pay back.

Imagine someone having an income of $50,000 and cost of living expenses of $70,000.

This person spends more than what he earns. To make ends meet, he borrows $20,000 from his credit card.

What will happen to him assuming that there is no way he can increase his income or decrease his expenses? He is going to be bankrupt.

But there is another solution:

” He can take on more debt”

To make ends meet, he needs to take on more debt just to survive.

He has no other solution but to take on more new debt just to pay his old debts.

This will lead to more debt, higher interest payments, more money needed when the debt is due. Then he will be needing more money because the bigger the debt, the bigger the interest.

That’s what the US Government situation is. Because the US government and most governments around the world, spends more money than what they earn, they don’t have any other choice but to borrow more money.

Ever since we went off the gold standard, there is no more limit on how much money can be created. And this creation of new money is done through issuance of new debt.

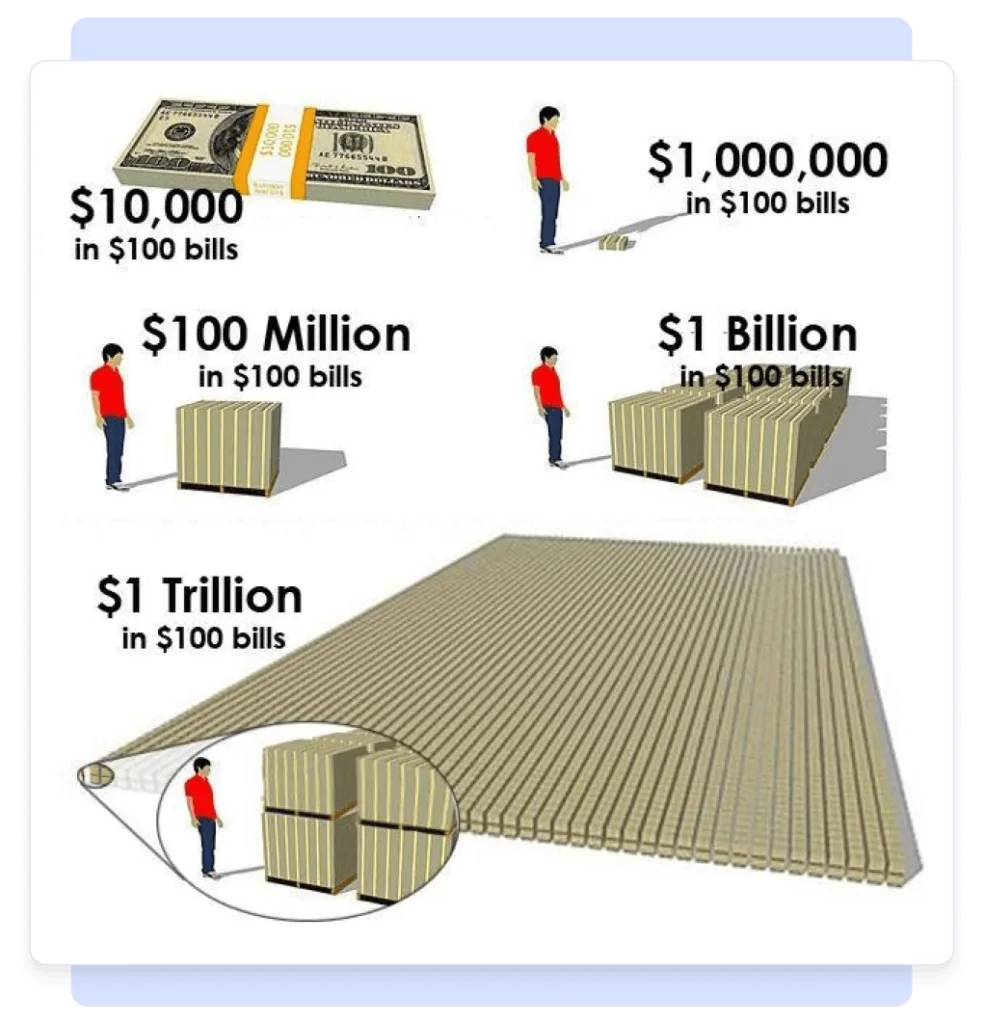

As of now, the total US debt stands at gigantic amount of $34 Trillion.

⛔Will the US default?

They won’t default because they can print more money to pay for their growing debt.

They do this through the Central Bank or in the US it’s called Federal Reserve.

The Central Bank is the one that literally prints our money.

So, in case when no one buys the Government bonds, the Federal Reserve will buy these bonds.

This Fed buying of government bonds happened during the Global Financial Crisis and happened again during Covid crisis.

The Fed balance sheet or the amount of newly created money out of nowhere went from under a trillion in 2008 up to now worth $8 trillion

Remember that US debt is also growing. They will be needing more debt to pay for their old debt. The higher the debt the higher the interest. The more debt they will need.

In summary, the US won’t default on their debt, they can issue more debt to pay more debt because the Central bank will buy those debts. Since gold was no longer money, the government can add and print more money through this US government issuance of more debt and the Central bank buying it.

There’s no way that the US can paid back its debt other than printing more money. They can’t raise taxes because that would lead to revolution. They can’t cut spending because a lot of this spending are mandatory like healthcare, retirement, defense or war expenses etc.

So, the game is just adding zeros. When more US treasuries are issued, this will result to more US dollars leading to more inflation.

I don’t mean to be a doomer saying that everything will collapse. Ever since we went off the gold standard in the 70s, there were people predicting the collapse of the dollar. Since the 2008 Financial Crisis happens, more people were convinced that the collapse of dollar is near.

No one can predict when that will happen, but if you understand fiat money, you will see the symptoms of a collapsing money.

I see it more of like a slow bleed to death. They can continue this game because they just keep adding the zeros, but the longer that happens, the longer the people suffer from debasement of their money and everyday lives. It will feel that each and every day gets harder and harder to get by because of rise in everyday cost of living.

This already happened in some countries like Zimbabwe, Argentina, Lebanon, Venezuela.

If you zoom out for the long term, you know you can’t save in cash. All of this shenanigan leads to your savings evaporating slowly over time.

Imagine if you had your savings in cash for the past 10 years, your savings has lost a ton of its purchasing value. You saved hard but you're not satisfied. Money that has inflation is not able to fulfill its role which should be store of value.

Like what we learn in chapter 2, money should be able to store your energy. Money should be able to store the fruits of your labor that you’ve done today and be able to use it 10 years later without loosing it’s value. Money that you received today from your work should be able to buy equal loaf of bread in the future 5 years from now.

But our fiat money today is not able to do that.

💰How money works in simple terms

The more you try to understand the monetary system we have, the confusing it gets. Because it has become a very complex mechanism. That is also the reason why even the experts and smartest of the smartest disagrees on what is money printing and inflation.

But let me save you some time, you don’t need to understand exactly the plumbing of our monetary system to understand what the real problem is.

You don’t need to understand or learn what the government is doing. Because the solution is not how they manage the money supply or government debt or what programs they will do to save or boost the economy. The problem itself is the money, because the money itself can be printed.

The real value in the world is the work that we do, or the goods and services we produce. It’s the service you provide as plumber or doctor. The fruits and beef you harvest and sell on a farmer’s market.

Those are the real wealth or value in the world. The problem is the money we used to measure this real-world wealth is broken, because the money can be printed. It’s like using a ruler that keeps on getting longer.

Whenever they print more money, the real wealth (plumbing, beef, fruits) gets devalued.

They don’t directly steal your goods. The nominal amount you received won’t also decrease. But what you can buy with the real wealth or value you provided will be less simply because they print more money.

So basically, inflation is just like also theft. But it is theft hiding in plain sight.

It is hard to pinpoint that, because of the complexity of how our monetary system has become. But to think about, it is simply because they print more money.

I always go back to my basic examples whenever I explained how money printing works.

🏝️Coconut Island

Imagine we live in a coconut island where the only goods that has value are 2 coconut trees.

The characters in this island are Me, You and the Government.

We begin with total money in this island of $20 distributed as follows:

You -$5

Me- $5

Gov’t - $10

The value the 2 coconut trees will be $10 each (total money supply of $20 divide by 2 trees)

What if the government suddenly doubled the money supply and added $20 more?

Total money now will be $40.

The price of coconut trees will double to $20 (total money of $40 divided by 2 trees)

The real wealth in this coconut island did not change, there are still 2 coconut trees. However, their price doubled suddenly because of money printing, it will become more expensive for you and me to buy coconut trees now.

Before money printing we are able to buy coconut tree for $10

After money printing, we need to work more because coconut trees now cost $20

Supporters of these money printing will argue that with the increase in money supply, our salaries will also increase. Yes, it’s true but salaries especially for most workers doesn’t keep up with the pace of increase in money supply because, when new money is created, it is not evenly distributed.

In fact, money printing in a fiat world has Cantillion effect. The Cantillon effect means that those who are closest to the money printed benefits the most.

If you are a worker that relies on your job, you are the farthest to this money printer.

Is the solution then is to have an equal distribution of money printed? That is not the real solution. That won’t happen also because that’s just simply how money printing works.

The real problem is that we have money that can be printed. Government will print it because this is their solution to our problems. But they don’t see that the problem itself is meddling with this money. Because every time they do that, they meddle with our lives, we the plebs that produce real value in our economy with our jobs. Because by managing the money, they change the price or value of what we do. We don’t have the ability to save money.

There is no way to fix this thru the system. Because fiat money is by designed to be increase in supply because of their growing debt.

Fiat money can be printed to infinity. There is no physical constraint that limits money printing. Previously it was gold, but we can’t use gold, we can’t do payments with gold. So, to solve this problem, we used paper backed by gold, the problem with this is that the governments will print more money than the gold they have.

It doesn’t matter what the intentions of the government are. By printing more money to solve our problems, it will lead to bigger problems over time which is inflation.

Printing money to solve problems is like using drugs for pain. The pain will go away now but you will suffer later for kidney failure.

Solving our problems through money printing is like a person that eat lots of junk foods trying to get healthy by drinking lot of vitamins. You can’t fix your health unless you change what you eat. In our monetary system, we can’t change the outcomes unless we change the fiat money. Fiat money is the junk foods.

A person with bad diet can’t fix his health through medications. He needs to change what he eats.

We can’t fix the inflation/recessions/inequality etc. with printing more money. We need to change the money.

Fiat money will be debased because the government have to because of their growing debt.

Unlike fiat, bitcoin enforces a fix supply. It is the antidote to fiat money. It is designed that way. Because no one, no matter what he/she/they do, they can’t create more bitcoin. The rules enforce that.

The next chapters will show how bitcoin is the exact opposite of fiat money.

NEXT: Chapter 4: The Greatest Magic Trick Ever