Early Retirement via BTC - Volume #1

Hi there, this is the first installment of this blog series called Early Retirement thru BTC.

I am buying BTC because well, I think it will continue to go up over time (not up always, there will be volatility).

One of the reasons why I’m buying BTC or investing in general is because I want to retire early. I want to have freedom someday to do what I want (whatever that is) whenever I want it.

I’m not too fixated with the goal of “when” I can retire. To me, I just want to stack as much as bitcoin as I can.

But I think it would be fun, to write about this. I do track how much I invest in BTC and my net worth (total value investments less liabilities or what I owe).

So here it is, volume #1 of my Early Retirement journey with BTC.

Note: amounts are redacted, I just show graphs, obviously I don’t want to dox myself revealing how much BTC I owned.

Fiat Stack

This is the value of how much I’ve put into BTC in monthly charts since I started buying in March of 2022.

This fiat money is combination of both my salary and debt I take on.

The noticeable dip from June to July 2024 is because I sold some cold storage BTC to buy MSTR shares and options (Not Financial Advice).

For the month of July 2024, I’ve added equivalent to 48% of my monthly salary to bitcoin (this are not all from my salary, it’s combination of debt and salary).

Net Worth

Here is chart of my net worth

Obviously, this is correlated to BTC, I only started tracking this in Feb 2024, you can see that it only goes up from there because that’s when bitcoin went from 40k up to as high as 74k, then rangebound from 58k to 70k. Recently, bitcoin price wicked down to $49k.

If you measure from the $74k, the wick down to $49k was a 30% retrace. This a lot, but historically, that is normal with bitcoin. Bitcoin is a volatile asset.

Speculative attack

This section is titled speculative Attack inspired by this article.

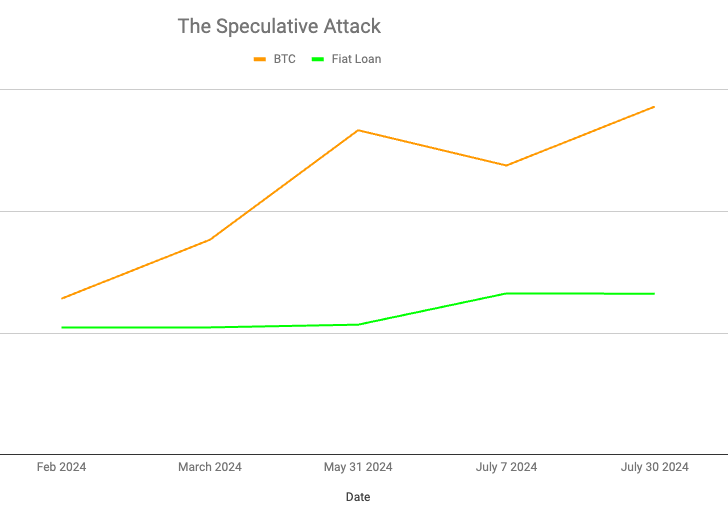

This chart visualizes the current value of my BTC stack (orange line) &

The fiat value (including interest) of my fiat debt.

Fiat debt line includes repayments, so it may go down and also up depending if I take on new debt to buy BTC.

As you can see from this chart, so far it has pay off because the value of my stack is almost double my loan.

But that is not always the case, do note that I only started tracking this since Feb 2024, this will show as positive since I bought these coins starting from March 2022, also the monthly repayments will make the green line trend lower (assuming I don’t get new loans).

There were times when my BTC stack was below the green line obviously, because I started buying in March 2022, I continued to buy ever since then.

Bitcoin Content

I recently enjoyed this podcast episode. The guest is Mauricio, founder of Ledn. He and his family flew out of Venezuela to escape the debasement of their currency. That’s how they found bitcoin.

Bitcoin is best understood/discovered when it is shown as a solution to problems of fiat currency.

That’s how I discovered it also, not on the extreme of hyperinflation but inflation. Also, I discovered it as an alternative investment that will outperform traditional stocks.

That’s it for this post. Hope you enjoy it!