Options #5 Speculating on MSTR moves

✌️Welcome to BuyBTCRetireEarly!

💸This newsletter is focused on achieving Early-Retirement through Bitcoin!

📚If your new to this Blog, start here!

If you prefer vido content, I also now have Youtube Channel!

Good news! I created a telegram group where we can connect and share ideas about investing, money and of course Bitcoin. Join by clicking this link: BuyBTCRetireEarly Telegram group

You can also join our Sub-reddit here.

Initially I’ve decided to buy a $700 call if we get a dip on MSTR but I couldn’t wait anymore.

I think the price of MSTR options to me are fair. Implied Volatility(IV) is almost near at 52 week lows in recent days suggesting that options prices are relatively cheap.

I think I could not wait no more if we dip. I am fomoing a bit. Sure things can still go down but I think there is a greater risk on waiting. If we did dip, that would be time to double down instead.

I have adjusted the call that I am going to buy to $650 Sept Call. I just feel safer on $650 than $700

My target profit is to sell if we hit $600 before June 2025. That will capture the FASB earnings adjustment and possible S&P inclusion. Also possible bitcoin move up.

I am not buying this option to be in the money. I am speculating that price of the option will go up when MSTR and IV go up even though the option won’t be in the money. It is possible that it will be also in the money on or before expiration. Those are the reasons why I am buying a call options that is less than a year. Generally, I don’t buy call options that is shorter than 1 year but this one will be a shorter term option trade.

Another key things that made me wanna buy are:

Low IV on bitcoin and MSTR

Consecutive fear/ netural readings of fear and greed sentiment.

The sentiment truly reflects that because sentiment on twitter IMO is bearish.

Meanwhile institutions are buying based on recent 13F filings.

That’s a good setup/conditions to buy IMO.

I am buying here. Again this is a trade that can loose my money. Whenever you buy options, assume that it will expire worthless. Or better said, make sure that the trade won’t wipe you out or your portfolio if the options expired worthless. In short, don’t bet the farm on one trade.

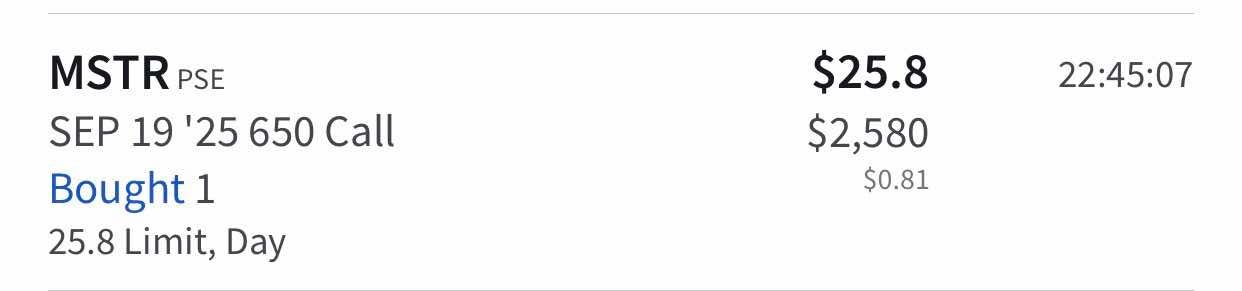

Cost to buy 1 Sep 19’25 $650 call option is $2,580

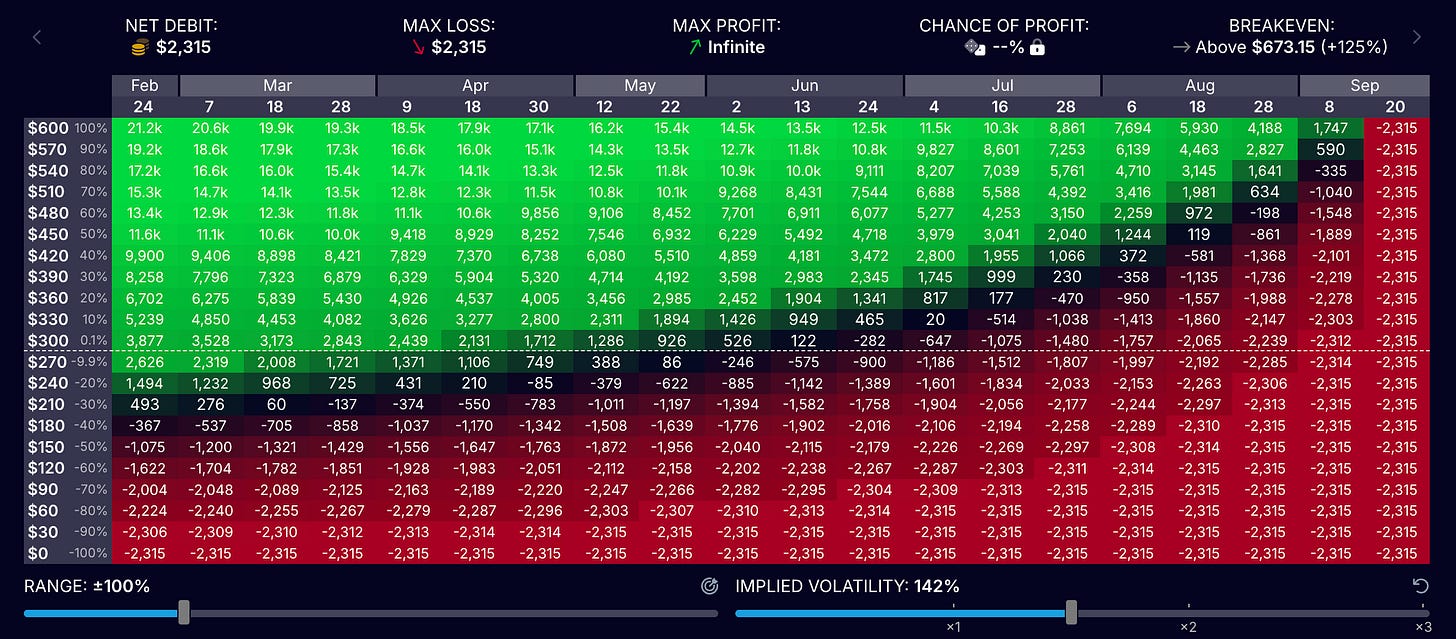

My target price for selling is MSTR at $600 on or before June 30.

If MSTR is not above $600 on or before June 30, I will re-evaluate what I am gonna do with this option.

Currently, this option is trading at 95% IV. Here are the expected profit at $600 at different IVs

Assuming MSTR is at $600 at that point at 95 IV(current IV level) , estimated profit will be $7,049

Assuming MSTR is at $600 at that point at 120 IV(25% increase) , estimated profit will be $9,924

Assuming MSTR at $600 on or before June 30 at 142.5 IV (50% increase), estimated profit will be $12,500

WARNINGS

Only bet what you can afford to lose. Don’t bet all your portfolio into options just because you wanted to magnify or leverage your gains. Options is like leverage. It is a risky play because you need to be right on a limited time.That’s why the first thing you should ask when buying call options is that am I willing to lose what I am going to bet?

Read a lot or watch a lot of YouTube videos about options. Also practice if you can before buying. I did practice buying some cheap calls on bitcoin miner before I bought BITO calls. I am also practicing selling covered calls and cash secured puts in preparation for the strategy I will be using for my IBKR portfolio.

Cold Storage, no leverage bitcoin is still the Gold (bitcoin) standard. Having a lot of cold storage bitcoin is still the best. Options has lot of risks. Cold Storage bitcoin should be the majority of your stack

📚Where to learn options?

Here is a tweet from X showing resources on where to learn options: https://x.com/btc_overflow/status/1880010930269880585

I agree with almost all the resources included in that post, so if you are interesting on learning about options. I suggest looking into those resources.

That’s it for this post. Hope you find this valuable.

Thank you for reading!