Options #6 Full Degen

✌️Welcome to BuyBTCRetireEarly!

💸This newsletter is focused on achieving Early-Retirement through Bitcoin!

📚If your new to this Blog, start here!

If you prefer vido content, I also now have Youtube Channel!

Good news! I created a telegram group where we can connect and share ideas about investing, money and of course Bitcoin. Join by clicking this link: BuyBTCRetireEarly Telegram group

You can also join our Sub-reddit here.

Since my last options post on Feb 21 2025, here are summary of the moves I made:

Roll down the Sept 2025 $650 call to Sept 2025 $320 call.

Bought more IBIT call options

Bought some short-term speculative options

My options position went from 50% to now almost 70%

Bitcoin (was $76k the bottom, wen moon?)

So bitcoin went down as low as $76k. Almost a 30% drawdown from ATH of $109k

I didn’t anticipated it (I’m not that good of a investor to know). But this is normal bitcoin price action.

The only thing I know is to buy bitcoin when it dips.

So I took this as my last buying oppurtunity (hopefully).

Roll down the Sept 2025 $650 call to Sept 2025 $320 call

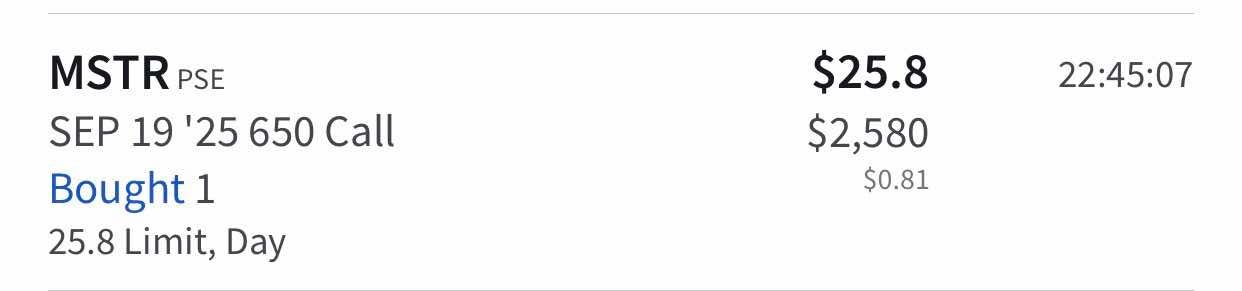

In my last options post, I bought the below option:

Initially I bought this to capture potential S&P500 inclusion to be sold when MSTR hits $600.

But MSTR dips, so I decided to roll it down, to a lower strike of $320

I expect this to be ITM at expiration.

I sold the original $650 call at a loss $1,143.70.

I then bought Sep 2025 $325 call at a price of 5,080

I also sold some shares to fund this purchase. So Im going even more long.

Whent to sell this: I still initially plan to sell this when MSTR hits $600

Bought more IBIT call options

Another thing I did is bought more IBIT call options.

I now hold 11 Jan 2026 $55 call options at average cost of $9.65

So my breakeven is IBIT at $65 ( $55 + $9.65)

IBIT at $65 is equal to $120,000 bitcoin price.

So this trade will be profitable when bitcoin is above roughly $120,000

Whent to sell this: I don’t know yet when I plan to sell this but I will probably sell some when bitcoin moves above $120,000, depending also on how much is the value of each contract because there will be also other factors like Implied Volatility and not just bitcoin price alone). Originally, I plan to hold at least half of these contracts close to expiration.

Bought some short-term speculative options

The last 3 options at the bottom are speculative/degen options I bought.

I will soon them as soon as my target price hits. I will report back whenever I have done that.

These could also expired worthless. I bought them at the time when MSTR 0.00%↑ is below or at $250. I thought they were cheap and I thought that MSTR could bounce back quickly. They already have small unrealize gain but I’m still waiting for MSTR to go up more. I am threading the needle here because these are way OTM. This means that their value will shrink as they reach expiration (theta decay).

My options position went from 50% to now almost 75 %

Here is an updated look at my portfolio as of March 20 2025

I decided to go long even more when I sold shares and bought the lower strike Sep 2025 MSTR calls and add more IBIT calls.

Now, the hard part comes next which is to just sit on my hands, and start taking profits ( hopefully).

WARNINGS

Only bet what you can afford to lose. Don’t bet all your portfolio into options just because you wanted to magnify or leverage your gains. Options is like leverage. It is a risky play because you need to be right on a limited time.

That’s why the first thing you should ask when buying call options is that am I willing to lose what I am going to bet?

Read a lot or watch a lot of YouTube videos about options. Also practice if you can before buying. I did practice buying some cheap calls on bitcoin miner before I bought BITO calls. I am also practicing selling covered calls and cash secured puts in preparation for the strategy I will be using for my IBKR portfolio.

Cold Storage, no leverage bitcoin is still the Gold (bitcoin) standard. Having a lot of cold storage bitcoin is still the best. Options has lot of risks. Cold Storage bitcoin should be the majority of your stack

📚Where to learn options?

Here is a tweet from X showing resources on where to learn options: https://x.com/btc_overflow/status/1880010930269880585

I agree with almost all the resources included in that post, so if you are interesting on learning about options. I suggest looking into those resources.

That’s it for this post. Hope you find this valuable.

Thank you for reading!