Options #7 Quick update

✌️Welcome to BuyBTCRetireEarly!

💸This newsletter is focused on achieving Early-Retirement through Bitcoin!

📚If your new to this Blog, start here!

If you prefer vido content, I also now have Youtube Channel!

Good news! I created a telegram group where we can connect and share ideas about investing, money and of course Bitcoin. Join by clicking this link: BuyBTCRetireEarly Telegram group

You can also join our Sub-reddit here.

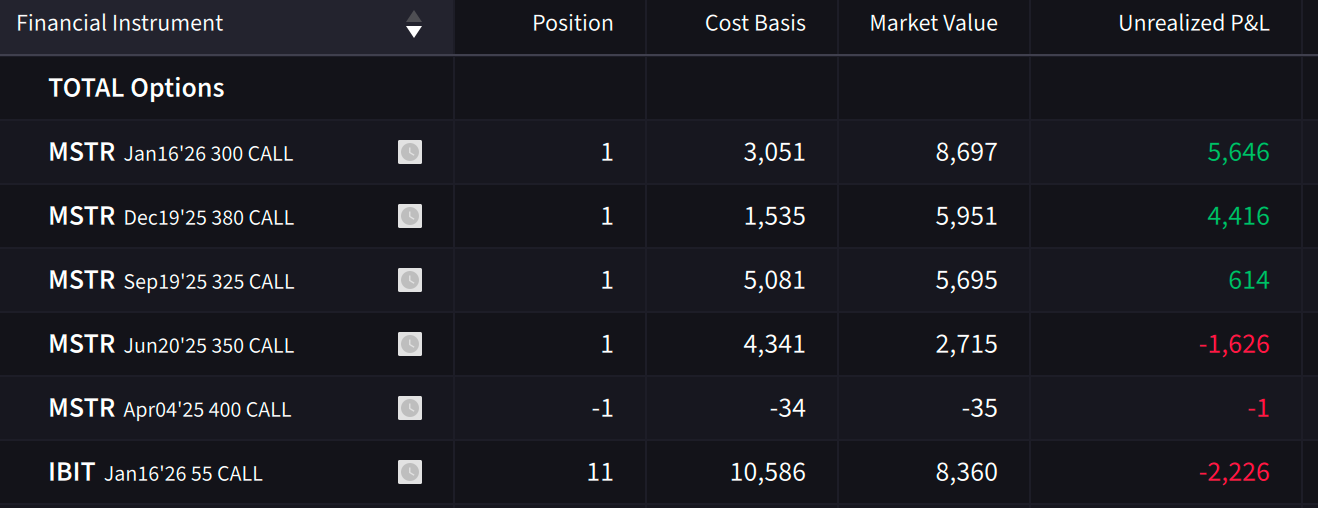

Just a quick update that I sold and rolled down the speculative short term high OTM calls (see last bottom 3 below) into a single June 2025 $350 strike. I will sell this when MSTR reach $400.

Here is an updated look at my call options:

WARNINGS

Only bet what you can afford to lose. Don’t bet all your portfolio into options just because you wanted to magnify or leverage your gains. Options is like leverage. It is a risky play because you need to be right on a limited time.

That’s why the first thing you should ask when buying call options is that am I willing to lose what I am going to bet?

Read a lot or watch a lot of YouTube videos about options. Also practice if you can before buying. I did practice buying some cheap calls on bitcoin miner before I bought BITO calls. I am also practicing selling covered calls and cash secured puts in preparation for the strategy I will be using for my IBKR portfolio.

Cold Storage, no leverage bitcoin is still the Gold (bitcoin) standard. Having a lot of cold storage bitcoin is still the best. Options has lot of risks. Cold Storage bitcoin should be the majority of your stack

📚Where to learn options?

Here is a tweet from X showing resources on where to learn options: https://x.com/btc_overflow/status/1880010930269880585

I agree with almost all the resources included in that post, so if you are interesting on learning about options. I suggest looking into those resources.

That’s it for this post. Hope you find this valuable.

Thank you for reading!