✌️Welcome to BuyBTCRetireEarly!

💸This newsletter is focused on achieving Early-Retirement through Bitcoin!

📚If your new to this Blog, start here!

If you prefer vido content, I also now have Youtube Channel!

Good news! I created a telegram group where we can connect and share ideas about investing, money and of course Bitcoin. Join by clicking this link: BuyBTCRetireEarly Telegram group

You can also join our Sub-reddit here.

The past weeks (month of April 2025) have been a roller coaster ride in traditional markets (due to tariffs)

The past months has been also a roller coaster ride in bitcoin but mostly only down.

Bitcoin went from the intraday high of $109,000 on Jan. 20 2025 to lows of $74,600 on April 07 2025.

That is a 30% correction:

In this post I will discuss the following:

Why is bitcoin going down?

My updated portfolio

Lessons/mistakes/realizations.

Why is bitcoin is going down?

So first thing first, why is bitcoin going down?

Frankly, I don’t know. I am not that smart and good of a trader to know why.

In fact, I was one of the normie during November/December of 2024 feeling that we’re going up only.

If you’ve been lurking in twitter or X, Josh Mandell predicted back in November 21 2024 that Bitcoin will close on March 15 2025 at $84,000

I saw that tweet on Nov 21 2024 and bitcoin just made new ATH of $98,000 that day.

I followed Josh and he was a former options market maker so he has credibility. But when I saw that tweet, it didn’t sit right with me. We had just hit all-time highs, and I was feeling overly bullish—basically caught up in the greed phase like a typical normie.

So fast forward to March 14, bitcoin close right around around $83,900 ish depening where you look at the price. Not exactly $84k but very very close.

So why am I telling this? I guess my point is that we are due for a correction.

The headlines is dominated by Tariffs, did it cause the sell off? Maybe, but some people were calling for a correction not just in bitcoin but in traditional markets like S&P500 and Nasdaq since December 2024 and early January 2025.

But hindsight is 20/20.

No one can predict what markets can do next week or months on a consistent basis.

That’s what is NOT I’m trying to do anyway.

So what is the point of telling all of this? The point is that looking back, we can learn if we remember what we felt and criticize & learn from what we did wrong or what we did not do. The point is to learn something so we can do better next time.

I was bulled up also during end of last year. So what did I do? I went farther and increase my risk by selling MSTR shares and converting to MSTR LEAPS.

The point is:

I was feeling too bullish when I should be careful/fearful.

I broke my rule of not betting more than 10% of my capital in LEAPS.

Of course this could have gone right if we did not went down. Like when bitcoin broke $30k in 2023, it continued to go up to new ATH of $74k in March 2024 then have a correction in August 2024 wicking down to $49k

But the point is to not predict short-term moves, that is not within our control.

The only thing we can do is to position our portfolio well.

Meaning don’t get too over-leveraged and greedy by owning many LEAPS.

I did not loose money, yet.

But the wick down to $74k was a wake up call to me to reflect on all of this.

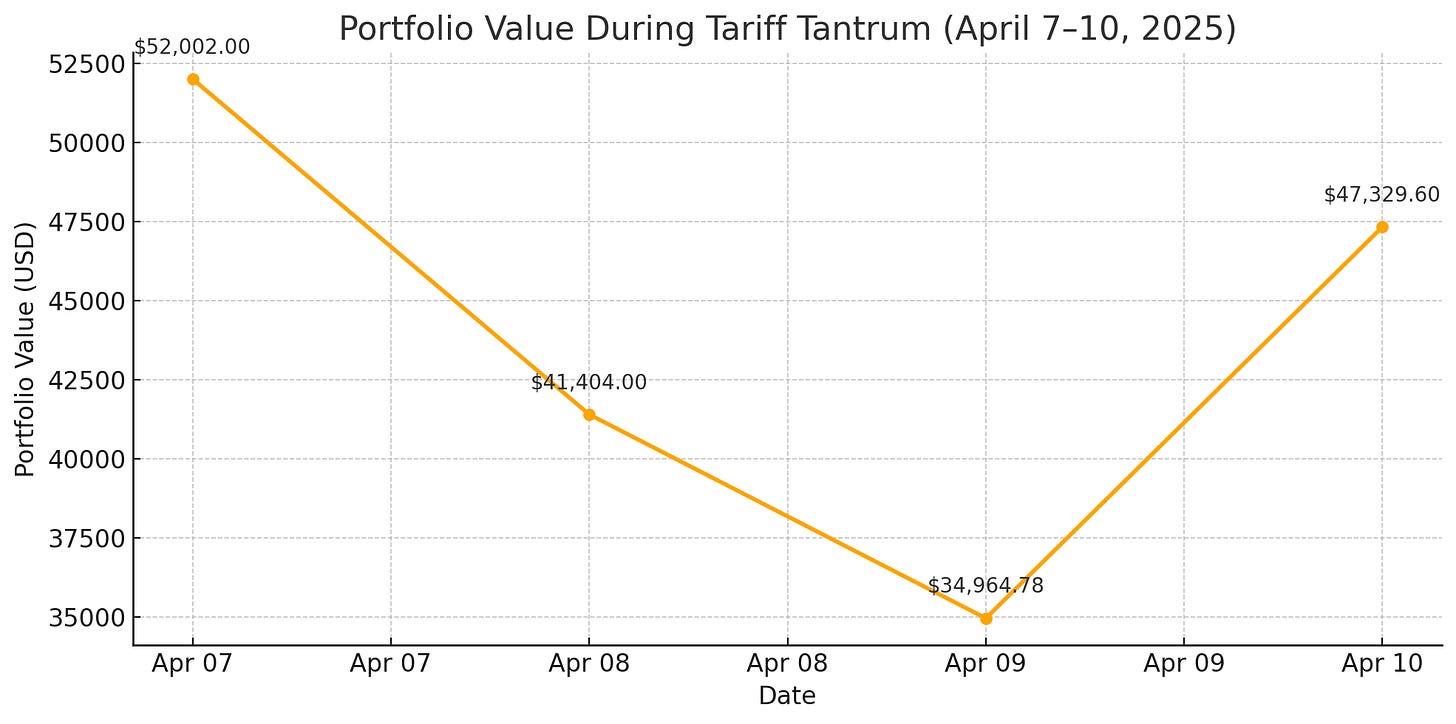

This is what happened to my porfolio during the Tariff Tantrum:

Luckily I did not panic sell at the lows (which is what most people do).

That was the peak panic that I felt. I thought of selling but did not pull the plug. I beleived that it will come back.

Traditional market has also one of the largest drawdowns in history. Fear & Greed index are at peak fear readings.

Like I said bitcoin was down 30% from ATH to recent low.

But this is a normal correction during bitcoin bull markets, but why the peak in fear?

I can’t speak for anyone, but for me here is the reason why I felt peak panic & fear and almost think of selling the lows:

It is because of expectations.

I expect bitcoin to go to highs of $200k to $400k this year ( which I still believe btw).

And of course the greed I was feeling because price was at all time highs last year.

So the challenge for me was to be objective during local tops.

I am good at local bottoms, I am buying during local bottoms (I bought at the lows of $75,000)

The challenge for me is to not let myself feel to greedy when we are at local highs.

Does it mean that I will sell at those highs? No, but not to be a buyer, because being patient and greedy can reward you.

For example if you bought the top of $74,000 on March 2024, you rode it up and down up to November 2024 . In fact you had the chance to enter at $49k or $50k during the Japan Yen carry trade fears in August or Sep of 2024 (That’s when I bought my initial MSTR leaps).

However, after that, I wasn’t being very careful anymore, I flip flop from holding shares to leaps, as you can see on my option series.

Looking back, If I had been very careful during the greed phase. I could have re-entered a position and bought the lows during this April Tariff peak fear.

You can’t predict. You can Prepare

-Howard Marks

Updated Portfolio

The only major changes I made were

sell the Sept 325 call option and convert it to cash &

sell the Jun 350 call and convert it to a Sept 350-400 Bull call spread.

sell short 5 $70 calls against the $55 long IBIT Jan 2026 expiry calls to make them bull call spread

bought Sep $55 - $65 bull call spread

ignore all the puts, the puts are for earning weekly yield on my cash position

currently, I am in 15% cash position

Here is an updated look at my options:

As you can see, I am still bullish on bitcoin. I have time ticking because calls have expiraiton date.

I havent sold them, I still believe that bitcoin will go to new ATHs this year.

Like I said before, I am looking to offload my MSTR calls at $600

I still beleive that at least $200k is possible for bitcoin this year.

Of course I could be wrong.

WARNINGS

Only bet what you can afford to lose. Don’t bet all your portfolio into options just because you wanted to magnify or leverage your gains. Options is like leverage. It is a risky play because you need to be right on a limited time.

That’s why the first thing you should ask when buying call options is that am I willing to lose what I am going to bet?

Read a lot or watch a lot of YouTube videos about options. Also practice if you can before buying. I did practice buying some cheap calls on bitcoin miner before I bought BITO calls. I am also practicing selling covered calls and cash secured puts in preparation for the strategy I will be using for my IBKR portfolio.

Cold Storage, no leverage bitcoin is still the Gold (bitcoin) standard. Having a lot of cold storage bitcoin is still the best. Options has lot of risks. Cold Storage bitcoin should be the majority of your stack

📚Where to learn options?

Here is a tweet from X showing resources on where to learn options: https://x.com/btc_overflow/status/1880010930269880585

I agree with almost all the resources included in that post, so if you are interesting on learning about options. I suggest looking into those resources.

That’s it for this post. Hope you find this valuable.

Thank you for reading!