✌️Welcome to BuyBTCRetireEarly!

💸This newsletter is focused on achieving Early-Retirement through Bitcoin! If you’re new to this blog, start here

Good news! I created a telegram group where we can connect and share ideas about investing, money and of course Bitcoin. Join by clicking this link: BuyBTCRetireEarly Telegram group

One of the most significant purchases you will ever make is buying a property.

A property serves as both a place to live and also an investment.

Many Filipinos prefer property as an investment because it is tangible and physical, unlike stocks which may not feel real.

People generally think that property prices go up over time.

However, events like the 2008 housing crisis or the real estate market in China have shown that this belief is not always true.

As our economy gets better, more people especially in Metro Manila where many condos are being built can afford to buy these properties as investments.

There are also a lot of real estate agents promoting pre-selling condos as investments.

If you think about it, how can a property that hasn't been built is an investment. Their rational is to say things like because it is still cheap because it is pre-selling.

I'm not saying that pre-selling condos or properties are scams, but the way developers advertise them may be misleading.

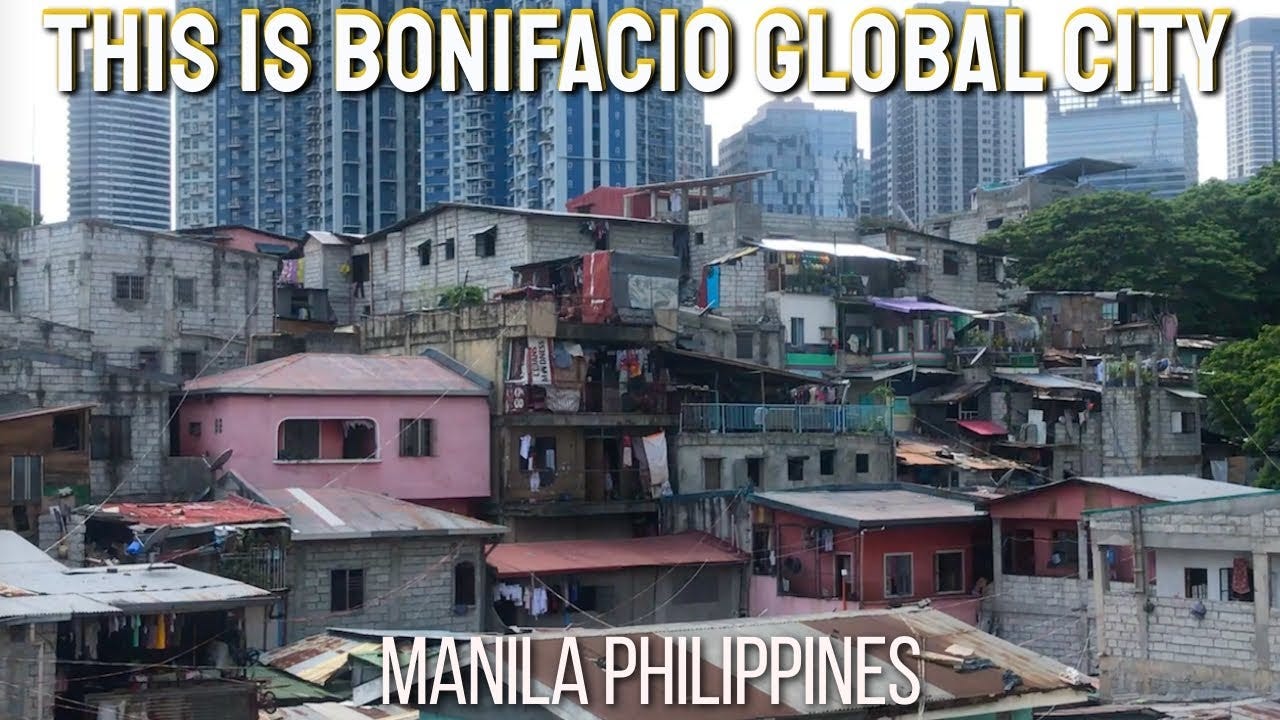

It is not unusual in Metro Manila to see condos being built left and right. I often see condos besides squatter or squatter like areas.

🏠Should you buy a house?

However, let's focus on the main question: should you buy a house? In my opinion, this is a straightforward question with a simple answer:

Buying a house is a case-by-case decision that depends on you and your family. The problem arises when people view buying a house solely as an investment.

Property can indeed be an investment, with the potential of value appreciation or rental income. However, the problem lies in the assumption that buying property only has advantages and no disadvantages.

To challenge this perspective, let's address the main problem with considering property as an investment: its lack of liquidity.

❌🏘️The biggest disadvantage of investing in Property

An investment is typically liquid, meaning it can be easily sold.

For example, stocks can be sold within seconds.

In contrast, property is not as liquid and can be challenging to sell, especially in the Philippines.

The problem with property investing is that when your put in a situation where you have to sell your investment property, it can be sometimes hard to sell.

Life circumstances can change, such as losing a job, taking a pay cut, or facing higher interest payments on mortgage due to rising interest rates. These things can force you to sell your investment property.

What's worse is that there are individuals who have bought property in the pre-selling stage cannot sell because they technically don't own the property yet.

They have no choice but to let go and forfeit the down payment they have made.

Many working millennials, especially those with increasing salaries, opt to buy houses instead of spending their money on shopping or other expenses.

The idea is to invest their income in a house rather than waste it. However, the problem is that we lack sufficient education about alternative investment options like stocks, gold, bonds, and others.

When you mention buying stocks or Bitcoin to your parents or others, they may give you a strange look.

However, if you propose investing in property, they will likely agree that it's a good idea. Saving money is another alternative, but it can be eroded by inflation over time.

These are the challenges we face when deciding where to invest our money, which is why it's understandable that many people end up choosing to buy property.

Nevertheless, I suggest thoroughly thinking it through because buying a property is probably the most significant purchase you will ever make.

If you approach it as an investment, consider your alternatives. You can invest in cash or other assets and take the time to carefully evaluate before blindly committing to a reservation fee for a condo that is five years away from being built.

Thanks for reading!

This newsletter is focused on achieving Early-Retirement through Bitcoin! If you’re new to this blog, start here

If you want to support my work, you can do so by donating to the following:

Lightning Address:

Wallet of Satoshi: stainedsail42@walletofsatoshi.com

Alby: ts4b@getalby.com

Alby page: click here

Follow me on:

Twitter: @btc4casuals

Nostr: npub1v8lwgdtjqtrgqxcwuftxkkge5vngjec69fncac76lkffjeqfh86snnc0z2

Telegram: BTCRetireEarly

More from DIY investing for FIlipinos: