Understanding MSTR Infinite money glitch

✌️Welcome to BuyBTCRetireEarly!

💸This newsletter is focused on achieving Early-Retirement through Bitcoin!

📚If your new to this Blog, start here!

Good news! I created a telegram group where we can connect and share ideas about investing, money and of course Bitcoin. Join by clicking this link: BuyBTCRetireEarly Telegram group

You can also join our Sub-reddit here.

MSTR is a bitcoin leverage company.

When you buy MSTR, you are not only buying a company that holds bitcoin.

You are buying a company that takes on debt to buy bitcoin. That is why MSTR 0.00%↑ is a leverage bitcoin company.

The result has shown so far that it is a bitcoin leverage company because MSTR outperformed bitcoin:

How MSTR uses leverage

You can make the case that the trade of the last decade and the next decade will be to short dollar long bitcoin. This simply means borrow as much as fiat as you can intelligently and buy bitcoin with the proceeds.

That’s what I have done in my personal life (of course Not Financial Advice).

MSTR is doing this on much larger scale.

Right now, they get their leverage from 2 sources:

1. Selling shares (At The Market offering) and buying bitcoin with the proceeds

2. Issuing Convertible Bonds and buying bitcoin with the proceeds.

This post will only discuss #1

Issuing Shares or At-The-Market (ATM) offering

ATM is not debt. ATM is simply MSTR selling more of their MSTR shares.

ATM is generally bad because it leads to dilution. If you own MSTR shares and MSTR the company, is selling more shares. Your MSTR shares in theory will become less valuable because there are more MSTR shares. Just like money printing when government prints more money, it makes your money less valuable.

ATM results to inflation of shares. But the value or impact of the ATM will depends on the use of proceeds from the issuance of those shares.

Companies usually uses the proceeds for capital expansion like building new factories, repaying debt etc.

In MSTR case, they simply buy bitcoin with the proceeds from ATM.

That’s why it is dubbed as “accretive dilution” because even though they dilute the shares, they are increasing their bitcoin holdings.

Many have been explaining the ATM or Accretive Dilution in a high-level way. But I think it is important to understand it in simple terms especially when more MSTR buyers are coming.

So here is my version of “Explain to me the ATM like I’m a Tradfi Investooor”

If you believe that bitcoin is going up forever (saylor number is 29% per year), then it’s good.

If you believe that bitcoin is not going to up forever like tradfi investoors do, then you think it’s dilution and bad and make your shares worth less.

So now that we’ve laid out a theory, let’s laid out the math in a simple example.

Let’s first define what mNAV is and what BTC per share is.

mNAV or market value to net asset is simply the multiple of market value of shares or the company is trading over its net assets (in MSTR case, bitcoin holdings less debts).

The mNAV premium will be calculated as follows:

The BTC per share is simply a metric that calculated how many bitcoins a share is entitled to.

mNAV is in dollar terms.

BTC per share is in unit terms.

The purpose of ATM is to take advantage of the mNAV premium to buy more bitcoin in a way that BTC per share will increase.

Let’s go on to different scenario on how this works.

Here is initial set up:

MSTR has 100 shares

MSTR has 500 BTC

Scenario 1: mNAV at 2 (premium)

MSTR has 100 shares trading at $10 per share

BTC holdings is 500 BTC trading at $1 per btc

The mNAV premium is calculated as follows:

The initial BTC per share will be at 5

ATM OFFERING:

MSTR then sold 10 shares at price of $10 and will receive $100 (10 shares X $10).

MSTR will buy bitcoin using this $100.

To keep our illustration neat, assume that BTC is still trading at $1

MSTR buys additional 100 BTC ($100 raised / $1 per BTC)

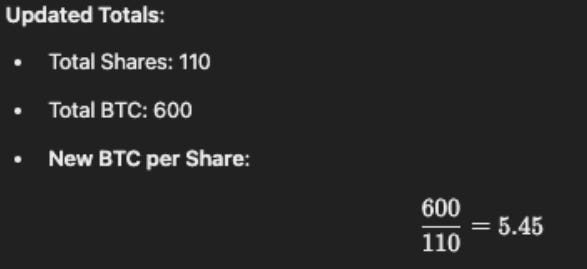

After the ATM offering, here are the updated numbers:

This is what they meant by accretive dilution; the shares have increased but the number of total BTC in unit terms per share increased.

Scenario 2 :mNAV 1 (neutral)

ATM OFFERING:

ATM offering is at 10 shares price at $5

$50 was used to purchase BTC at $1 per share resulting to additional 50 BTC . Here are the updated totals:

When NAV is 1, it doesn’t make sense on BTC per share standpoint alone to issue new shares. The company will have more bitcoin, but on a per shareholder basis, it doesn’t accrued value to shareholders since BTC per share didn’t increase.

Scenario 3: mNAV .50 (discount)

Let’s take a scenario when the NAV premium is trading at a discount.

ATM OFFERING:

Issued new 10 shares at $2.5 resulting to $25 cash

$25 was used to purchase BTC at $1 per BTC resulting to additional 25 BTC.

Here are updated results:

The BTC per share decreases, meaning existing shareholders are diluted without any gain in BTC per share. It doesn’t make sense to issue MSTR shares at this point.

The point of these examples is to show how it is advantageous for MSTR to issue new shares when mNAV is trading at a premium. As long as the market value of the company is trading above its bitcoin holdings, it will make sense to issue shares and buy bitcoin.

But of course, this is not how as simple as it sounds, the examples are for illustrative purposes only. The share price of MSTR and BTC price always change and are very volatile.

Infinite Money Glitch

Many have dubbed this issuance of shares when mNav is trading at premium then buying bitcoin w/ the proceeds as infinite money glitch. But is it really?

It is not infinite money glitch, it is just intelligent use of how capital markets works.

Tesla use to issue a lot of ATM also before to fund their expansions. I guess it turned out well because they are now a Trillion Dollar Company.

Only time will tell if these MSTR playbook will also turns out one of the greatest moves in history of capital markets. I believe it is, because I believe in bitcoin.

Also MSTR is not limited to just issuing shares. They also currently issue debt or convertible bonds and buy bitcoin.

MSTR has also laid out future plans or possibilites on how they can get more leverage in the future to buy more bitcoin. If you want a deep dive into those, I sugges watching the Q3 earnings call:

MSTR can continue issuing shares as long as the company will trade at a premium to it’s bitcoin holdings. The question then is why it will trade at a premium; I made that case here in this post:

Thank you for reading!

If you want to support my work, consider donating via lightning:

Alby page: click here

Wallet of Satoshi: stainedsail42@walletofsatoshi.com

You can follow me on the following:

Telegram: BuyBTCRetireEarly Telegram group

Reddit: r/BitcoinPilipinas

Twitter: @btc4casuals

You can also find me on NOSTR:

npub1v8lwgdtjqtrgqxcwuftxkkge5vngjec69fncac76lkffjeqfh86snnc0z2