I titled this Substack DIY investing for Filipinos but I rarely talk about the Philippine stock market.

Why is that? Because I don’t have investment in the Philippines stock market.

In this post, we will discuss the reasons why I don’t invest in the PH stock market.

⁉️Why Filipinos invest in the PH stock market?

Most Filipinos that have investments probably owned PSEi mutual funds or UITFs or blue-chip stocks like Jollibee, Ayala, SM, San Miguel etc.

These are stocks of companies that Filipinos are very familiar because we often use their products or services.

Home bias is a phenomenon that generally occurs within equity markets. It is commonly believed to be driven by emotions rather than objectivity. Investors with home bias tend to stick with investments with which they're familiar. As such, they'll invest in the stocks of domestic companies rather than those in foreign markets. That's because these investors have a greater degree of comfort in choosing investments in their own country1

Another reason is that most of the online stock brokers we have in the PH don’t have exposure to global stock market.

So in short, the reason why most Filipinos only invest in PH stock market are the ff:

Home Bias

Lack of convenient and cheap alternative to PH stock market (more on this later).

🌱The Growth of Filipino Investors

The development in technology has made investing more accessible to everyone. Gone are the days when you need to phone your broker just to buy stocks.

Today you can buy investments through your mobile phone using online brokerage accounts like COL Financial and FirstMetroSec. I believe you can also buy investments now through Gcash!

The internet has contributed to spreading awareness about investments. Because of the internet we have now what we call ”finance influencers”.

The danger is that most of this influencers’ advice are trash because they make money on creating content and views, not on how valuable their content is.

That’s why I always suggest that books are still the best way to learn. Not Youtube videos from mainstream “personal finance gurus”.

It’s harder to read books than to watch pleasing personal finance vlogs. But if you really want to learn, you need to put in the work.

Aside from books, informative blogs like this are also helpful.

Now that I have shamelessly plug my blog/Substack, let’s move on to the reason why I don’t invest in the Philippine stock market.

🤔Why I don’t invest in the PH stock market?

The reason that I don’t have a substantial percentage of my investments in PH stock market is because I don’t see any potential growth in the Philippine economy in the near term.

IMO we do have potential growth in the future because of our demographics. Our population is growing.

But this growth in demography takes a lot of years before they show up in the economy or the stock market.

🔥The Philippines is an Emerging Market

In investment terms, the Philippines is classified as an Emerging Market.

Countries are classified by investment research firms into Developed, Emerging and Frontier markets. Below image is classification of countries done by MSCI - one the world’s leading research firm that provide indexes.

Emerging market deserves an allocation in any well diversified-investment portfolio.

Even though PH is an emerging market, there’s no reason to overweight your investments in PH because like I said earlier, I don’t see any potential growth in the PH stock market.

I do own the following ETFs that has broad diversification among emerging market countries:

iShares MSCI Emerging Markets ex China ETF(Ticker; EMXC)

iShares Latin America 40 ETF (Ticker; ILF)

Technically, I do have allocation in the PH stock market because EMXC ETF has 1% allocation in the PH stock market.

Philippines is a very very small stock market

I don’t focus my time studying the Philippine stock market because that’s not where the money is. There is no global demand for Philippine stocks

In year 2020, the US has the biggest stock market valued at $40.7 trillion dollars. The Philippines was valued at only $272 billion dollars. 2

The Philippines is less than 1% of the total world stock market.

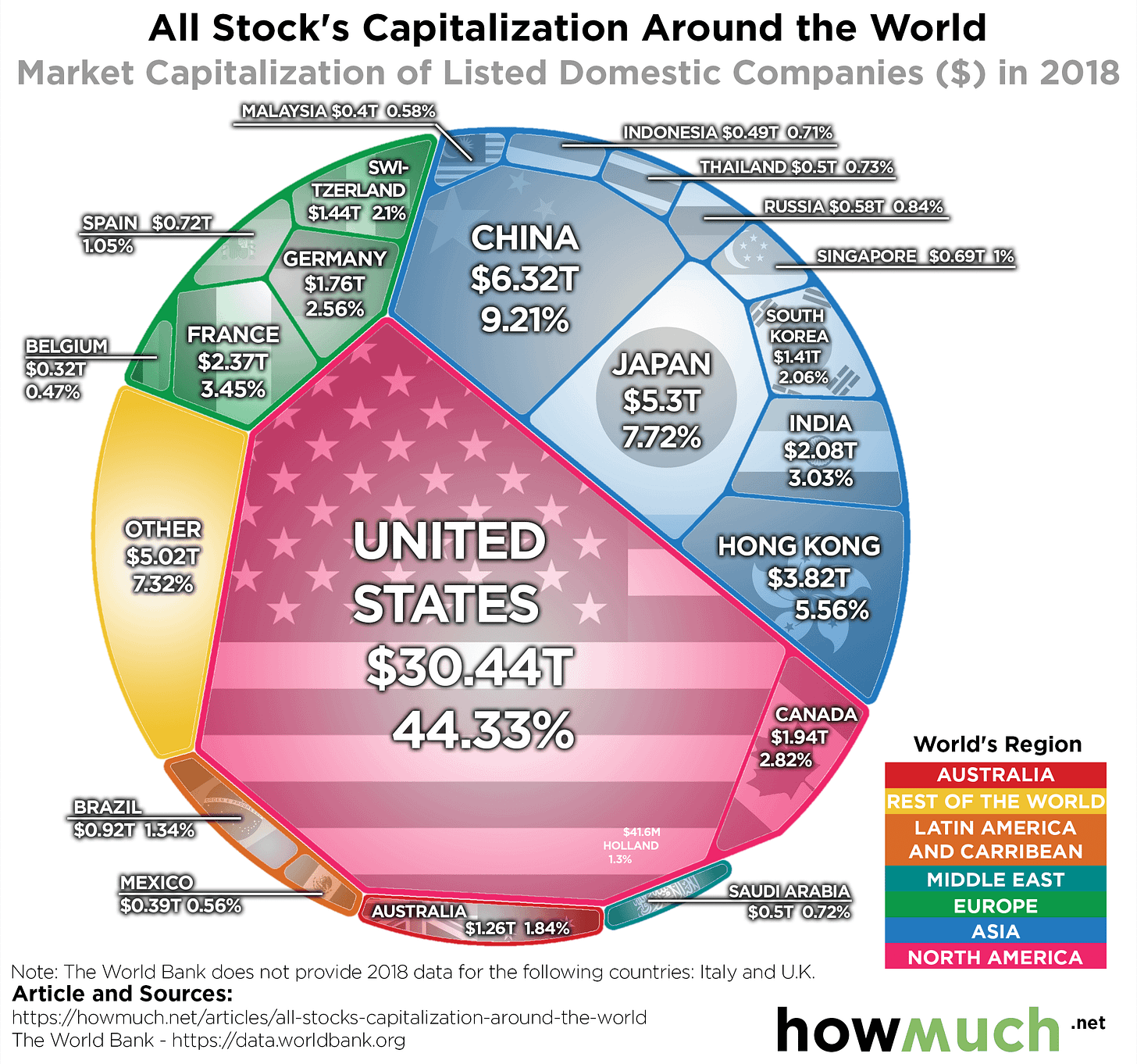

The below image is a good visualization of the world stock market. Though the data is outdated because it’s from year 2018:

🎌Which country to focus instead?

If you are an investor, the market or country that you should pay attention to is the United States of America.

Why the US? Because, we live on a US dollar standard. Meaning the US dollar is the world’s reserve currency.

Whether we like it or not , we are affected by US dollar even though we don’t use it in our daily lives.

It affects us because most imports and exports are denominated in US dollars.

For example, the Philippine exports coconut products to Saudi Arabia, Saudi Arabia pays the Philippines in US dollars.

When Philippines buys and imports oil from Saudi Arabia, the Philippines pays Saudi in US dollars. None of these countries have US dollar as their nations' currency but they both transact using US dollars.

This is probably the reason why the US has the most valuable companies on Earth. Because they have the world’s reserve currency status.

That gave them the ability to buy cheap goods because their currency is strong.

That is the reason also why foreigners can go to the PH and it will cost them cheap to travel here. On the other hand, us Filipinos cost a lot of money to travel in other countries because of our weak currency.

Weak PHP relative to developed countries’ currency is the reason also why our labor is cheap. That’s why we have many OFWs.

That’s why also we have many foreign companies outsourcing their labor force here in the Philippines

Fun fact, I work for an Australian company as an accountant!

The work that is done by an employee in the US or AU etc. is the same work that is done by an outsourcing employee here in the PH. The difference is that the labor here in PH is cheap.

It is cheap not because it is of lesser quality, its’s cheaper simply because the USD is a strong currency relative to PHP.

As you can see, the US dominate the stock market in terms of market capitalization.

Most of my investments are domiciled in the US. But I diversify my investments in other countries too via ETFs.

🚩Lack of cheap and convenient access to global capital markets

Back in 2018, I wanted to invest in the S&P 500 index funds. The problem I had is that I can’t find a cheap way to do this.

Back then, I found a way to buy S&P 500 index funds through banks. But you need to have a US dollar bank account and the minimum investment is very high compared to my salary at that time.

The minimum is $1,000.00 (around P50,000.00). For context, I was earning P20,000.00 at that time. I wasn’t able to buy S&P 500 index funds at that time because I can’t afford it.

Related Post: Should you still buy Equity-index funds?

Security Bank Equity index feeder fund:

BPI INVEST U.S. EQUITY INDEX FEEDER FUND:

The good news today is that we have apps where you can now invest in Global stock market for low amounts. These are apps like GoTrade, Shari-shari, Etoro etc.

I personally don’t use these apps but I have tried some of them before. I choose a more reputable online broker which is Interactive Brokers(IBKR).

The barrier with using Interactive Brokers is that you need either a Passport or Drivers License to create an account. They don’t accept other IDs.

You also need dollars to fund your account. I’m funding my IBKR account using Wise. I used my credit card to add dollars in my Wise account.

TD Ameritrade is also another popular online broker with good reputation.

With IBKR or TD Ameritrade, you will have access to a lot of stock markets around the globe.

Disclaimer: Please do your own research before using any of these platforms. None of this is financial advice. DYOR before investing.

That’s it for today post! I hope you learn something new!

If you like this post, check out my other articles:

Should you still buy Equity-index funds?

How to retire early for Filipinos : A personal story

The information provided on this blog is for educational and general informational purposes only. It is not intended as professional financial advice and should not be construed as such. The content on this blog is based on personal experiences, research, and opinions of the author and does not represent the views of any organization or institution.

The author is not a licensed financial advisor, planner, or accountant, and does not hold any certifications or qualifications in the field of finance. Readers should seek the advice of a licensed professional before making any financial decisions. The author is not liable for any damages or losses arising from the use or reliance of the information provided on this blog.

Is the international stock broker you have withheld tax everytime you have gains in your investing? Are you a VA po? I'm a VA too for a US client (Accountant also).