Chapter 2: "What is Money?"

This post is Chapter 2 of the book I’m writing. You can read the Introduction here

Let’s set aside everything we think we know about money and try to define it as simply as possible. In economics classes, we learn the textbook definition: money is a unit of account, a store of value, and a medium of exchange.

Those are the academic terms—precise but abstract.

I prefer to define money in a way that feels more relatable to everyday life, to what it means for you and me as ordinary workers. The definition I use is simple:

“Money is a measurement”

Stay with me—this won’t feel like a boring high school math class.

Just as we use inches or centimeters to measure height, and kilograms or pounds to measure weight, money is also a measurement. But what does money measure?

“Money measures the value of our work or our job”.

Like a weighing scale or a tape measure, money is just a tool we use to measure. If I asked you why you work, you might say, “for the money.” That answer is technically correct—but it’s not the real answer. Money itself is just paper or digital numbers. So why does almost everything we do revolve around how much money we can earn?

We study in school to get good grades, so we can get a good job, so we can earn good money. But why do we want this piece of paper called money?

It’s not the money itself we want—it’s what money can buy. Money is never the end goal. We don’t work because we simply want paper bills. We work so we can exchange our effort for the things we need or want.

Seen this way, money is a measurement tool for the value of our work.

Once you view money this way, you’ll realize something important: money that can be printed steals from us. Inflation makes money a faulty measuring tool—like using a weighing scale that someone can secretly tamper with, or a ruler that can be shortened or lengthened at will.

Imagine buying 2 kilograms of apples from me. But because I can manipulate the scale, I claim it weighs 2.5 kilograms. You end up paying more than the apples are truly worth.

Or imagine buying a piece of land that is actually 100 square meters. But because I can change the way measurements are defined, I tell you it’s 120 square meters. You think you’re buying more land than you are.

By altering the measurement, I can cheat you. This is exactly how inflation works.

Inflation is theft—but it isn’t obvious. We’re never taught this in school. Most of us don’t learn how money really works. We’re too busy thinking about how to earn more money so we can buy this or that.

Whenever the government prints more money, they are effectively changing the measurement. Every time the money supply increases, the reality of everyday workers like you and me becomes distorted.

The more money that is printed, the more currency chases the same limited amount of goods, which drives up prices.

By printing money, the value of our work declines. The money we earn buys less, so we must work even harder just to keep up.

All of this happens because the money we use today can be created at will—a money whose “measurement” can be changed without our consent. And we’ve been conditioned to believe that:

“Money printing = inflation” is good.

But in reality:

“Money printing = everything becoming more expensive” is bad for everyone.

⚡Money is stored energy

Most people earn just enough to get by. If you’re lucky enough to have money left after paying for food, rent, and other necessities, you either spend it on wants or you save it.

Money isn’t just a tool to buy things—it is also a way to store our energy.

Think of money like a battery. When you work, you’re charging that battery. Your labor is the electricity; money is the battery that stores that energy for future use.

Later, you use that battery to power something—a lamp, a gadget, an appliance. In life, you spend the money you’ve earned (your stored energy) to buy food, clothes, or even big future expenses like a house or your child’s education.

This analogy is powerful because it shows what inflation really does. Inflation, or money printing, doesn’t just raise prices—it steals your energy. It reduces the stored value of your work.

The book Your Money or Your Life talks about this exact concept: money is life energy.

If you work and earn $5,000 a month, that $5,000 is the stored value of the time and energy you spent that month.

If you work 8 hours a day, 5 days a week, that’s 160 hours a month. Your hourly rate is $31 ($5,000 ÷ 160 hours).

Now imagine you’ve saved $310,000 to buy a house. That represents 10,000 hours of your labor.

But because the government prints more money, inflation drives the price of the house up to $350,000. You now need to work an additional 1,290 hours just to buy the same house you already saved for.

Inflation robs us quietly. We accept rising prices as “normal” without questioning why. We don’t see that it’s the direct result of money printing.

Inflation is not just rising prices—it is the devaluation of our work and our energy.

Inflation is theft hiding in plain sight.

So far, we’ve learned that:

“Money is a measurement tool”

“Money is stored energy”

Understanding money this way changes everything. Money isn’t just paper bills or numbers in a bank account. It represents the time, energy, and productivity of our lives.

And yet, our current money is deeply flawed because those in power can change its measurement. Every time they print money, they silently take away the value of our labor.

🖨️Why do we print money?

Modern money evolved into something that can be printed because it had to adapt to the modern world. But money was not always like this.

To understand why money printing leads to inflation—and why Bitcoin matters—we need to look at the history of money. History shows us that money keeps evolving to solve the flaws of earlier systems.

“The more I study history, the less shock I am of current events.”

- anonymous

📜A Brief History of Money

Just a disclaimer that this summary is a simplified one. There are better resources to read if you really want a deep dive on the history and evolution of money. This won’t be an exact detailed history of money. I’ve just taken the most important parts that will help you understand why we need bitcoin today.

🤼Barter

Before money existed, people used barter—the direct exchange of goods and services. “I’ll give you this if you give me that.” That’s barter in its simplest form.

Think of it like this: your mother asks you to wash the dishes while your sibling is tasked with cleaning the living room. You don't like washing dishes, so you ask to switch tasks. That’s a barter of chores.

Or imagine you order ice cream for dessert and your wife gets cake, but halfway through she decides she wants your ice cream. You trade desserts. That’s also bartering—assuming you had a choice.

Now imagine trying to barter something more complex: you want to trade your sedan for a pickup truck. I happen to have one—but I only want a motorcycle, not your sedan. In that case, no trade happens.

This problem is known as the “lack of double coincidence of wants.” You and I must want exactly what the other offers. Without that, no trade is possible. This inefficiency is what led to the invention of money.

🐏Beads, Shells, Animal teeth, Livestock etc.

As barter became more complicated, people began using certain objects as a medium of exchange: beads, seashells, salt, livestock, and even animal teeth.

These early forms of money were chosen for convenience, but they had a major flaw: they were too easy to obtain. And good money, by definition, should be scarce.

Scarcity means it’s hard to make or find. If money is easy to get, it becomes ripe for abuse—especially by those who control its creation. A dark example of this is what happened in Africa during the slave trade.

The Slave Trade

Glass beads were used as currency in Africa in the 16th century. Africa didn’t have the technology to produce glass beads. Meanwhile in Europe, they had the technology to produce these glass beads. Some suggest that in the 16th century, Europeans brought these easy to produce beads to Africa to buy their resources. Some suggest that this also led to the slave trade in Africa. Europeans with their easy to produce beads bought African resources and also slaves. 123

This is the downside of having money that can be easy to obtain or produce by others. Real wealth like natural resources or land can be bought by cheap or easy money. Even human beings were bought as slaves because of easy-to-get money. These benefit those who are the closest to the production of this easy to produce money.

Money should be hard to produce or hard to get. This is called hard or sound money.

🪙Metallic Coins

Eventually, people transitioned to metallic coins made from precious metals like copper, silver, and gold. These metals were harder to find, mine, and refine—qualities that made them sound money.

They couldn't be produced out of thin air, unlike shells or beads. Their scarcity gave them real value, and they became widely accepted as money.

The Fall of Roman Empire

By the year 117 AD, Rome had conquered much of the known world. During the Roman Empire, they were using silver money called Denarius which has 4.5 grams of silver. But like any government at that time, success means more rising costs. To pay for the rising cost of running the Roman Empire, they produced more silver coins. They did this by reducing the grams of silver in Denarius coins.

The empire cannot make more money because they are limited by the silver they had, unlike shells or glass beads, you can’t easily obtain silver.

But in order to create more money, the empire instead reduced the grams of silver used in their coins. This is an early example of money printing. They reduced the silver required in coins so they can print more Denarius coins to pay for their expense.

This leads to more money circulating resulting in inflation. This led to hyperinflation that caused social unrest, revolution and wars. The Roman Empire ceased to exist by 476 AD.

This story has been repeated throughout history: when money is debased, societies collapse.

🏆Gold Standard

Eventually, people found a better system: the gold standard.

Gold was scarce, durable, divisible, and widely accepted—but it wasn’t practical for everyday transactions. So merchants began storing gold and issuing paper receipts to represent it.

If someone wanted to buy something, they could use these paper receipts. Whoever held the receipt could redeem it for actual gold. Thus, paper money backed by gold was born.

Governments later adopted this model. In the 1800s, the UK fixed the price of gold at £4.25 per ounce; the US fixed it at $20.67. You could exchange your currency for gold at any time.

Because this system limited how much money a government could create, it kept inflation in check. Governments couldn’t print more money than the gold they held—unless they broke their promise.

Which, eventually, they did.

💔Trust is meant to be broken (always when government is involved)

Just as the Roman Empire devalued its currency by reducing the silver content in the Dinar, the UK suspended the convertibility of paper money to gold during WWI to fund the war effort. The US followed suit in 1933 when FDR issued Executive Order 1602, which required citizens to sell all their gold to the government for $20.67 per ounce.

The official reason for this was that the Great Depression had led to gold hoarding, which slowed economic growth. The US was on the gold standard at the time, and the government claimed it needed to prevent further hoarding.

However, the real reason was to print more money. After seizing all the gold, the government raised the price of gold from $20.67 to $35 per ounce.

Why did they do this? Essentially, by raising the price of gold, they could issue more paper money. The physical amount of gold didn’t change—it was still the same weight. But by changing the price from $20.67 to $35, the government increased the monetary value of its gold reserves without acquiring more gold.

It’s like this: Imagine I have 2 kilograms of apples. Instead of saying it’s worth 2 kilograms, I claim it’s worth 2.5 kilograms—because I can. The amount of apples didn’t change; I just changed the price.

The same thing happened with gold. The US didn’t acquire more gold; they simply redefined its value.

This is the inherent flaw with money controlled by the state, empire, government, or any centralized authority. Whether it happened in the Roman Empire, the UK during WWI, or the US during the Great Depression, the issue is always the same: money, when controlled by a few, loses its integrity.

This issue is known as Centralization.

Centralization means control, and when the government controls money, the temptation to print more is inevitable.

That’s why Bitcoin was created to be decentralized—its very nature is the opposite of centralized money. It’s the antidote to the control that centralized money entails.

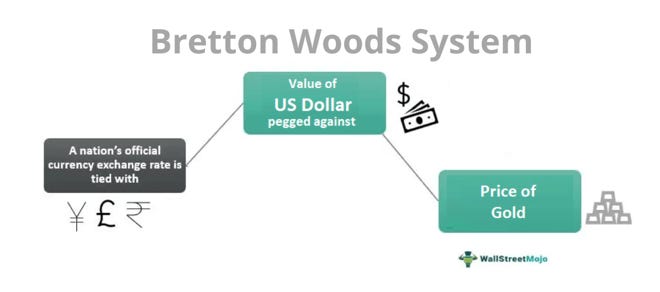

🏛️Gold Exchange Standard (Bretton Woods System)

After the Classical Gold Standard, which was interrupted during the world wars, the world moved to a Gold Exchange Standard.

The Gold Exchange Standard was established by 44 countries at the Bretton Woods Conference in New Hampshire in 1944. The goal was to create a system that would facilitate international trade by establishing a common currency—gold.

However, since countries had broken the direct link between their currencies and gold, they needed a common currency for trade. At this time, only governments held gold, while individuals and companies, who also traded internationally, didn’t. Additionally, governments didn’t like using gold as money because it limited their ability to print more money.

The solution was the Gold Exchange Standard.

How the Gold Exchange Standard work

Only the US dollar could be converted into gold.

Foreign currencies could be converted into US dollars, but not directly into gold.

At the time, most of the world’s gold reserves were held in the US. Countries would trade using USD as the common payment currency. The US dollar was essentially backed by gold—like a vault holding gold, with the US acting as the vault. This system worked well as long as the US didn’t print more dollars than they had gold to back them.

The issue, however, was that the system was centralized. And as we’ve seen throughout history, any empire or government with this kind of power is tempted to print more money.

And so, the US did.

🫨WTF happened in 1971

In 1971, President Nixon suspended the convertibility of US dollars into gold under the Bretton Woods Agreement. This effectively meant that money was no longer backed by anything.

Under the Bretton Woods system:

Foreign currencies could be exchanged for US dollars.

The US dollar, in turn, could be converted into gold.

The idea was that the amount of USD in circulation should be equal to the amount of gold the US held. However, in an effort to boost the economy and finance expenses like wars, the US printed more dollars than they had gold to back them.

The French caught onto this and began demanding their gold back. Fearing they would run out, the US decided to suspend the convertibility of dollars to gold.

This moment is crucial because it marked the shift that allowed inflation to become the norm.

Under the Gold Exchange Standard, you couldn't print more money without having gold to back it. Paper money was directly tied to gold, meaning you couldn’t issue more money than the gold reserves allowed.

This is when we moved to the Fiat Standard—money that is backed by nothing.

SUMMARY

Don’t worry, you don’t need to memorize all of this. The key takeaway is that money has continually evolved throughout history.

We moved from bartering to using simple forms of money like seashells, to using hard money like coins, then to paper money backed by gold, and eventually to the US dollar, which was initially backed by gold.

Each step in this evolution aimed to address the problems of the previous system.

The main lesson we’ve learned is that money should not be easy to produce. It should be scarce and limited, like gold. However, since gold is difficult to carry around for everyday transactions, we used paper money backed by gold. This paper money was originally issued by merchants as private money, but eventually, governments took over and issued paper money backed by gold.

In essence, gold was the true money, but since using physical gold for transactions wasn’t practical, paper money backed by gold became the solution.

However, governments exploited this trust and power. They couldn’t resist printing more money than they had gold to back it. The problem is that we are trusting governments to honor their commitments, but as history shows, they often abuse this power.

When governments create money simply by printing paper, it benefits a few while harming the masses. This is what happened to African slaves, and today, we are modern-day slaves to money printing. As we will see in this book, inflationary, easily printed money makes the rich richer while the rest of us suffer.

This easy, inflationary, printed money is called Fiat money. Since we moved off the gold standard in 1971, money has no longer been backed by anything physical in the real world. It’s now backed solely by the trust in the government.

What backs our money now? Chapter 3 will answer that.

Bitcoin fixes this

Bitcoin addresses the problems that fiat money creates.

Fiat money is inflationary and controlled by the government, making it prone to manipulation. History shows that money has evolved to address the flaws of previous systems. Each new form of money solves the problems of its predecessor.

Today, the flaws of our current money system are not always obvious, largely because the government tells us that inflation is necessary for economic growth. I'm not suggesting some grand conspiracy by the government to control us, like the Illuminati, but rather that the system itself is broken. The money we use is broken.

Many politicians may have good intentions, believing they can fix the system by managing the money supply or improving tax collection. But they fail to recognize that the current system is harming us. By continuing to expand the money supply through spending, they are causing more long-term damage.

This is why Bitcoin maximalists are so passionate about Bitcoin—they see it as a long-term solution to the problems caused by fiat money.

Bitcoin is the direct opposite of fiat money.

Unlike fiat money, which can be printed endlessly, Bitcoin has a fixed supply of 21 million coins. Unlike fiat money, which is controlled by governments, no one controls Bitcoin.

Money evolves to adapt to how we live. We live in a hyper-connected, globalized world. For example, I work for an Australian company while living in the Philippines. If we were still using physical gold as money, the logistics of paying my salary would be a nightmare. It’s not practical.

We can’t go back to paper money backed by gold either, because that system failed once trust was broken.

We need money that can be easily transferred but not printed recklessly. We need money that we can hold ourselves, without needing to trust governments or banks.

This is why I believe Bitcoin will eventually become the future of money. It may take years or decades, and no one knows for sure when that will happen. But if you understand the history of money, you’ll see that our current system has flaws, and we need a better form of money—Bitcoin.

You don’t need to wait for Bitcoin to officially become money before you buy it. If you recognize its potential early, it will benefit you as an early adopter.

Although Bitcoin isn’t money yet, those who have held it since its inception have seen their net worth grow in fiat terms.

The great thing about Bitcoin is that while many start out just looking to make money, as they learn more, they realize it’s not just a speculative investment. It’s also a way to fix the money system and make the world a better place.

We defined money earlier as a store of energy. If you use Bitcoin as a savings tool, you’ll have a better way to store your energy.

Bitcoin is becoming money as more people adopt it, which is driving its price up. But this won’t be a smooth ride—it will be volatile. You’ll need strong conviction to hold Bitcoin long-term. That’s why it’s important to zoom out and study the history of money.

Once you understand the history of money, you’ll see the flaws of our current system and realize that Bitcoin is the solution. The world may not see it yet, but they will soon, because all fiat currencies are destined to fail.

As Michael Saylor, a prominent Bitcoin advocate, said in a podcast, “If we can fix money, we can fix 50% of the problems we’re facing in the world.” I believe that’s true.

Money isn’t just paper; it’s a tool that represents the stored energy of everyone. When governments print more money, they distort this reality, and it shows in every aspect of our lives. We feel the effects of inflation in our daily lives, making it harder to get by. Inflationary money discourages saving and long-term thinking, leading to a culture of instant gratification.

This is why Bitcoin is so refreshing. It may seem like a long shot, but Bitcoin can fix this. Stable money will lead to a new beginning.

Will Bitcoin become money? I believe it will, because understanding the history of money shows us that we are constantly evolving. No one knows when Bitcoin will fully replace fiat money, but I’m confident it will.

It’s only natural to expect fiat money to fail soon, and when it does, we will find a better form of money. We already have that better money: Bitcoin. It’s just not obvious to everyone yet.

What is obvious, however, is that fiat money has flaws. Sadly, not everyone sees it today. But if you’re reading this, you will. You’ll see that Bitcoin is the solution, and that’s the real reason to hold Bitcoin. It’s not just about hoping the price goes up—it’s about investing in a system that can fix the world’s financial problems. There’s no other asset that can do that except Bitcoin.

Next: Chapter 3: “How money is created in Fiat”

Lightning Address:

Wallet of Satoshi: stainedsail42@walletofsatoshi.com

Alby: ts4b@getalby.com

Alby page: click here

Follow me on:

Twitter: @btc4casuals

Nostr: npub1v8lwgdtjqtrgqxcwuftxkkge5vngjec69fncac76lkffjeqfh86snnc0z2

Telegram: BTCRetireEarly